Top Builders

Explore the top contributors showcasing the highest number of app submissions within our community.

Arc

Arc is a purpose-built, EVM-compatible Layer-1 blockchain advancing the frontier of stablecoin finance and tokenization. It features USDC as native gas, deterministic settlement finality, opt-in privacy, and a stable transaction fee architecture. Optimized for stablecoin-native use cases, such as global payments, FX, and capital markets, Arc serves as a foundational settlement layer for programmable money on the internet.

| General | |

|---|---|

| Company | Circle Internet Group |

| Website | Arc Network |

| Documentation | https://www.arc.network/litepaper |

| Type | Layer-1 Blockchain |

| Launch | Public Testnet Fall 2025, Mainnet Beta 2026 |

| Consensus | Malachite (Byzantine Fault Tolerant) |

| Compatibility | EVM-Compatible |

Core Architecture

Malachite Consensus Engine

- High-performance Byzantine Fault Tolerant (BFT) consensus

- Built on Tendermint algorithm with Rust implementation

- Sub-second deterministic finality (under 350ms with 20 validators)

- Performance up to 10,000 TPS with 4 validators

- No probabilistic confirmations or chain reorganizations

USDC as Native Gas Token

- Transaction fees paid directly in USDC stablecoin

- Predictable, dollar-denominated costs for enterprises

- Eliminates volatile crypto token exposure for gas payments

- Enhanced EIP-1559 fee mechanism with weighted moving averages

- Stable transaction fee architecture optimized for business use

EVM Compatibility

- Full Ethereum Virtual Machine compatibility

- Seamless migration of existing Ethereum applications

- Support for existing developer tools and frameworks

- Native integration with Solidity smart contracts

Key Features

Deterministic Settlement Finality

- Transactions achieve irreversible finality in under 1 second

- No risk of chain reorganizations or reversals

- Guaranteed final settlement for enterprise applications

- Superior to probabilistic finality models

Built-in FX Engine

- Institutional-grade Request-for-Quote (RFQ) system

- 24/7 on-chain foreign exchange and settlement

- Payment-versus-Payment (PvP) atomic swaps

- Support for multiple stablecoin pairs (USDC, EURC, etc.)

- Perpetual futures markets for stablecoin trading

Opt-in Privacy Controls

- Confidential transfers hiding transaction amounts

- Addresses remain visible for compliance

- View keys for selective disclosure to regulators/auditors

- Trusted Execution Environment (TEE) implementation

- Future support for MPC, FHE, and Zero-Knowledge proofs

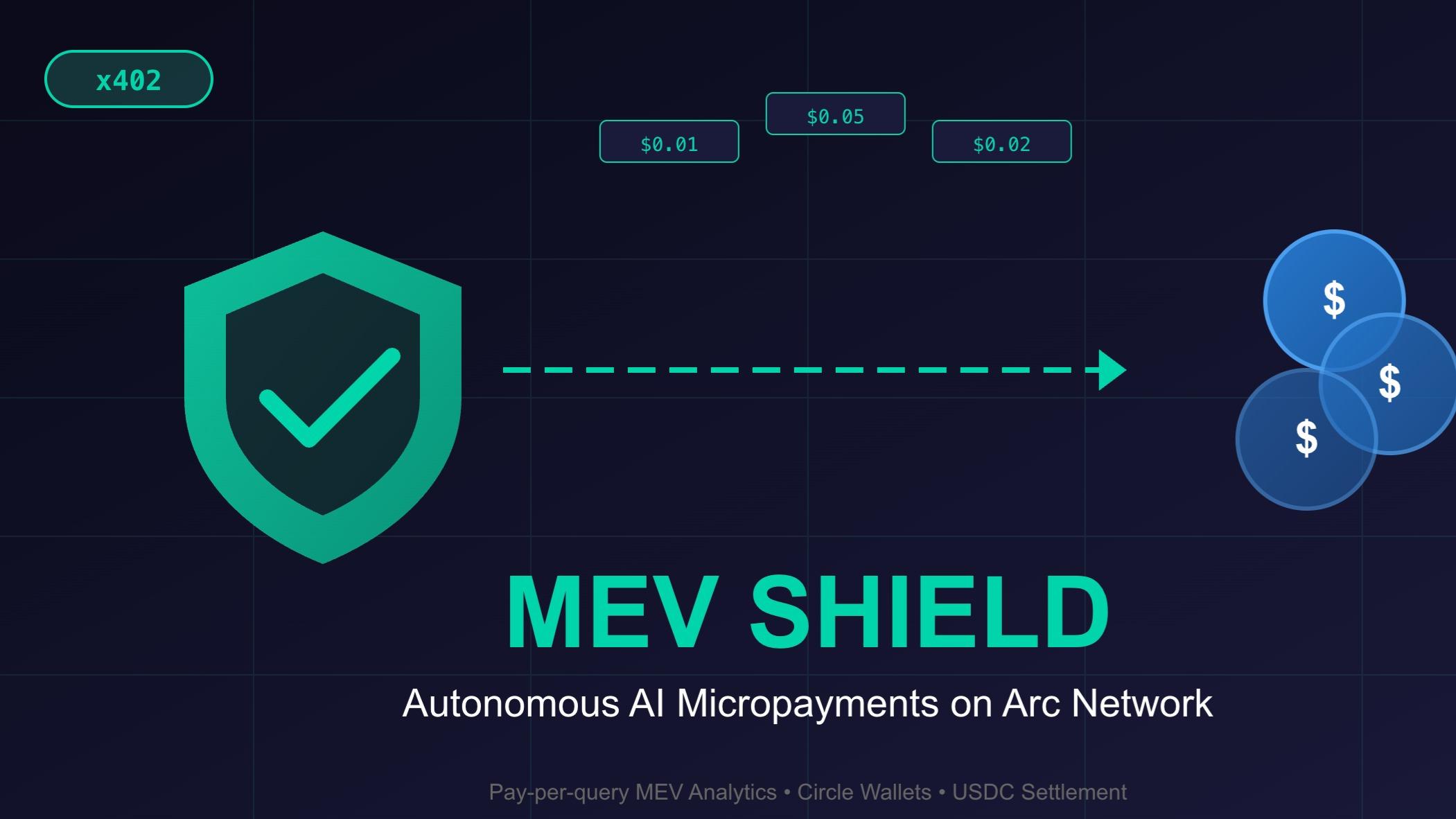

MEV Mitigation

- Classification of constructive vs. harmful MEV

- Encrypted mempools to prevent front-running

- Batch transaction processing

- Multi-proposer mechanisms for fair ordering

- Protection against sandwich attacks and value extraction

Enterprise Integration

Circle Platform Integration

- Native support for Circle Payments Network (CPN)

- Full integration with USDC, EURC, and USYC tokens

- Circle Mint, Wallets, and Contracts compatibility

- Cross-Chain Transfer Protocol (CCTP) support

- Gateway interoperability service integration

Real-World Asset Tokenization

- Support for tokenized equities, bonds, and securities

- Private credit and institutional fund tokenization

- Partnership with licensed asset issuers and custodians

- Regulated real-world asset (RWA) framework

- Compliance-ready tokenization infrastructure

Institutional Validator Network

- Permissioned Proof-of-Authority consensus initially

- Hand-selected institutional validators

- Geographic distribution of validator nodes

- High compliance and regulatory standards

- Future transition to broader validator participation

Use Cases

Global Payments & Remittances

- Cross-border payments with instant settlement

- Reduced intermediary costs and complexity

- 24/7 operation independent of banking hours

- Multi-currency stablecoin support

Capital Markets & Trading

- Institutional trading settlement

- Tokenized securities and derivatives

- Automated delivery-versus-payment (DvP)

- Real-time collateral management

Foreign Exchange

- On-chain FX trading and settlement

- Stablecoin pair perpetual futures

- Institutional-grade price discovery

- Automated currency conversion

Treasury Management

- AI-powered treasury optimization

- Yield-bearing stablecoin integration (USYC)

- Programmable finance workflows

- Automated compliance reporting

Technical Specifications

- Throughput: 3,000-10,000 TPS depending on validator count

- Finality: Sub-second (100-350ms) deterministic settlement

- Consensus: Malachite BFT based on Tendermint

- Virtual Machine: Ethereum Virtual Machine (EVM) compatible

- Gas Token: USDC native gas payments

- Privacy: Opt-in confidential transfers with compliance features

- Interoperability: Cross-chain bridges and CCTP integration

Development Timeline

- Private Testnet: August 2025 (launched)

- Public Testnet: Fall 2025

- Mainnet Beta: 2026

- Full Production: TBD with community and regulatory readiness

Arc represents Circle's vision for a stablecoin-native financial infrastructure that bridges traditional finance with programmable blockchain technology, designed specifically for enterprise adoption and regulatory compliance.

Arc AI technology page Hackathon projects

Discover innovative solutions crafted with Arc AI technology page, developed by our community members during our engaging hackathons.