9

5

Pakistan

1 year of experience

I’m Muhammad Awais, a Computer Science graduate from NUML Rawalpindi with a passion for AI, data engineering, and blockchain innovation. I’ve built solutions that earned recognition at my university’s Final Year Project competition, the P@SHA ICT Awards, and even received IGNITE funding for blockchain development. Along the way, I became a Datacamp Certified Data Engineer & Analyst, with hands-on experience in Azure Synapse, Data Factory, Databricks, Stream Analytics, and Power BI, as well as coding in Python, SQL, JavaScript, React, NodeJS, and Solidity. I love sharing knowledge — I served as a Section Leader at Stanford’s Code in Place, teaching Python to beginners, and as a Microsoft Student Ambassador, where I organized workshops on Azure, blockchain, and quantum computing. I’m also proud to have won the Harvard CS50X Puzzle Competition in 2024. Outside of engineering, I’ve moderated major communities like Crypto Awaz (Pakistan’s largest blockchain group) and LimeWire AI (a leading generative AI community). On the creative side, I’ve worked as a top-rated video editor on freelance platforms, completing 400+ projects. At heart, I’m motivated to create transparent, intelligent, and scalable solutions that bring the best of AI, blockchain, and cloud technologies together.

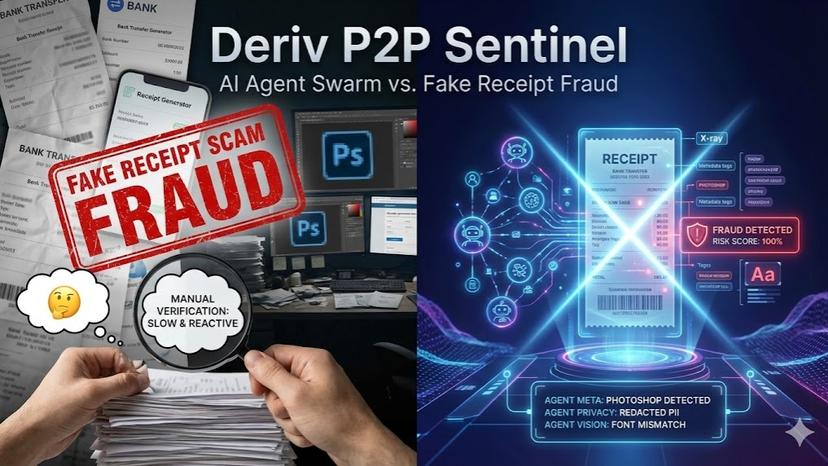

The Problem: P2P crypto trading is plagued by a simple but devastating scam: The Fake Receipt. Fraudsters use tools like Photoshop or Canva to forge payment proofs, tricking traders into releasing funds before receiving actual payment. Manual verification is slow, error-prone, and unsustainable at scale. The Solution: Deriv P2P Sentinel is an autonomous defense system powered by a swarm of specialized AI agents working in harmony to detect fraud instantly. How It Works: Agent Meta (The Detective): Scans the image file for hidden metadata traces left by editing software (like Photoshop, GIMP, or Canva) and verifies device fingerprints. Agent Privacy (The Guardian): Automatically detects and redacts sensitive PII (Personally Identifiable Information) such as phone numbers and names using OCR and Regex, ensuring data privacy compliance before external processing. Agent Vision (The Analyst): Leverages Google Gemini 1.5 Pro to perform cognitive visual analysis. It spots subtle font inconsistencies, misalignment, and pixel-level artifacts that the human eye misses. Key Features: Sci-Fi HUD Interface: A "Glass-Morphism" tactical dashboard that visualizes the AI's thought process in real-time. Risk Scoring Engine: Aggregates findings from all agents to provide a clear Trust Score (0-100) and actionable verdict (Approve/Review/Reject). Vercel Monorepo Deployment: Fully deployed scalable architecture with Next.js frontend and Python FastAPI backend. Tech Stack: Frontend: Next.js 14, Tailwind CSS, Framer Motion Backend: Python, FastAPI AI/ML: Google Gemini 1.5 Pro, Tesseract OCR Deployment: Vercel (Serverless Functions) Deriv P2P Sentinel transforms compliance from a bottleneck into a competitive advantage, ensuring trust in every transaction.

7 Feb 2026

The $3B global freelance market is broken by a massive "Trust Gap." Buyers fear paying for bad work, and sellers fear non-payment. Traditional platforms solve this with slow manual arbitration and rigid 14-day hold periods, stifling economic velocity. ArcWork is the solution: The Economic OS for Agentic Freelancing. We are the first platform where capital, humans, and machine agents coordinate with sub-second finality. By combining Circle's Programmable Wallets with Gemini's multimodal reasoning, we have replaced the "gig economy" friction with programmable, autonomous trust. How It Works: Smart Escrow: The buyer deposits funds into a smart contract on Arc L1 (using native USDC). Multimodal Work Submission: The freelancer submits their work (code, designs, files). Agentic Verification: Our Gemini-powered AI agent analyzes the submission against the original Scope of Work, inspecting text, images, and file contents. Trust-Minimized Release: Success: If the work matches the requirements, the AI triggers the smart contract to instantly release the funds. Risk: If anomalies are found, a "Tactical HUD" alerts the buyer to manually review or request revisions. The Tech Stack: Settlement: Arc L1 for deterministic, low-cost finality. Treasury: Circle Programmable Wallets for secure, developer-controlled fund management. Efficiency: Circle x402 Protocol for "Gasless Validation Credits," allowing freelancers to pre-check their work using AI, off-chain before final submission. Intelligence: Google Gemini 2.5 Flash for high-speed, multimodal semantic understanding of complex deliverables. ArcWork is not just a marketplace; it is a protocol for high-velocity, usage-based services where trust is code.

24 Jan 2026

📉 The Problem: The High Cost of Clean Data For AI companies, data preparation is the single biggest bottleneck. The Cost Crisis: Centralized services like Scale AI charge massive markups (500%+) to cover corporate overhead. The Blockchain Barrier: Previous decentralized attempts failed because Gas Fees (on ETH/SOL) destroy unit economics. A company cannot efficiently pay $0.01 per label if the transaction fee is $0.05. 🚀 The Solution: Aigarth DataLabel Aigarth DataLabel is a B2B Data Marketplace built on Qubic that allows AI companies to crowdsource data verification at a fraction of the market rate. By leveraging Qubic’s feeless infrastructure, companies pay directly for results, not overhead or gas taxes. ⚡ Value Proposition for Companies 90% Cost Reduction: Because Qubic has zero transaction fees, companies pay only the worker's wage. Automated Quality Control: Our custom C++ Smart Contract enforces a "Rule of 3" consensus mechanism. A label is only accepted (and paid for) when multiple independent workers agree, guaranteeing high-accuracy datasets without manual oversight. Instant Scale: Companies can upload a dataset and tap into a global pool of verifiers immediately. Qubic handles the instant micropayments, removing payroll friction. Aigarth-Ready: We are optimized to generate Trinary Logic (-1, 0, 1) data, specifically positioning client companies to leverage the upcoming Aigarth ecosystem. 🛠 Tech Stack Core: Qubic Smart Contract (QPI) for trustless consensus and payout logic. Frontend: Next.js + Three.js "Corporate Terminal" interface. Integration: Qubic TypeScript Library for real-time batch processing. We are building the Scale AI of the decentralized web- feeless, fast, and enterprise-ready.

7 Dec 2025

The cryptocurrency market is a minefield where 99% of traders lose money, largely because no tool exists to tell them what to ask. While generic chatbots provide vague summaries, there has never been a dedicated system that actively investigates a project's technical and forensic health, until now. BlockchainSeeker is the first Agentic AI platform designed to automate professional-grade due diligence. It solves the "Information Asymmetry" problem by deploying a swarm of specialized agents that work in parallel, mimicking the workflow of a hedge fund research team but accessible to everyone. Unlike standard analysis tools, our system utilizes IBM watsonx Orchestrate to manage a hierarchy of intelligent agents, each with a specific mandate: The Orchestrator (Parent Agent): The first AI designed solely to manage a crypto audit workflow. It breaks down user queries (e.g., "Audit Solana") and commands child agents to execute specific forensic tasks. CodeAuditor (Child Agent): Goes beyond simple searches to verify repository health, commit velocity, and "dead code" signals that human investors often miss. NewsAnalyst (Child Agent): A specialized sentiment engine that filters global media to separate genuine utility from paid influencer marketing. RiskDetective (Child Agent): A forensic investigator that cross-references projects against a proprietary logic of known scams, rug pulls, and legal threats. BlockchainSeeker isn't just a chatbot; it is the first fully autonomous defense system for Web3 investors.

23 Nov 2025

We built a Coral-first CFO Agent that shows what practical, agentic AI can do for finance teams today. The agent runs as an executable inside a local coral-server and is invoked via the Session API; it reads messy subscription CSVs, normalizes fields, and applies transparent heuristics to score every subscription for "keep" or "cancel." High-priority cancellation candidates are surfaced in a compact, prioritized list and when an LLM is available, the agent produces JSON-formatted, actionable next steps and short risk checks that a finance person can follow immediately. This project is intentionally modular and beginner-friendly: for the demo we use a simple subscriptions.csv file (easy to replace with S3, a billing connector, or a UI upload). The frontend streams the agent’s logs over WebSockets so you can watch parsing, scoring, and reasoning happen in real time. Architecturally, it demonstrates Coral’s strengths : remote-agent orchestration, reusability of agent code, and clean integration points ,while delivering tangible business value: immediate cost-savings, negotiation paths, and an audit-ready trail of recommendations. It’s a production-minded blueprint for agentic finance assistants that businesses can plug into their systems and iterate on.

21 Sep 2025