🤝 Top Collaborators

🤓 Latest Submissions

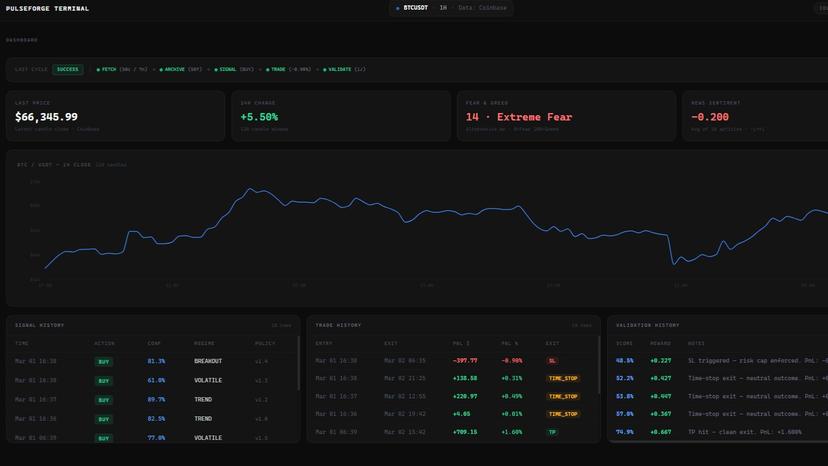

PulseForge

PulseForge is a production-ready multi-agent AI trading intelligence system built on Complete.dev. Instead of relying on a single black-box model, PulseForge operates as a coordinated network of specialized agents responsible for data ingestion, structured memory indexing, signal generation, deterministic trade simulation, and reward-based validation. The system continuously fetches market data, news, and public signals, stores them in a Supabase-backed memory layer, and generates regime-aware trading signals with structured explanations. Each simulated trade is executed using deterministic risk logic (stop-loss, take-profit, slippage, and fees), then scored by a validator agent using accuracy, risk efficiency, drawdown control, and confidence calibration. These validation rewards are fed back into adaptive policy weights, allowing the system to evolve strategy selection across different market regimes (trend, range, volatility). A single Manager endpoint orchestrates the full intelligence loop: Fetch → Store → Signal → Execute → Validate. PulseForge demonstrates how collaborative AI agents can form a self-evaluating, adaptive decision engine — transforming trading signals into structured, improving intelligence.

2 Mar 2026

Lunar Graph - AI-Powered Fraud Ring Detection

Deriv's compliance teams face 2,100+ fraud alerts weekly, 95% false positives. Each investigation takes 25+ minutes, creating weeks-long backlogs. Meanwhile, fraud rings go undetected because every individual account passes KYC, AML, and risk checks perfectly. The insight: fraud is invisible individually — it's obvious at the network level. LunarGraph maps every entity (partners, sub-affiliates, clients, trades, payments) into a knowledge graph, then deploys three AI agents in parallel: Graph Anomaly Agent — Detects structural patterns like one partner controlling 20+ accounts through layered sub-affiliates sharing IP addresses and device fingerprints. Temporal Intelligence Agent — Identifies coordinated opposite BUY/SELL trades placed within 30-second windows across linked accounts (mirror trading for commission extraction). Behavioral Trajectory Agent — Compares partner behavior against known fraud signatures to predict emerging schemes 2-3 weeks before activation. The platform connects to the real Deriv WebSocket API. Partners invite affiliates via unique referral links, each generating a tracked trading account with a TradingView-style interface. Every trade feeds into the graph engine for real-time correlation analysis. An AI Copilot synthesizes findings into case reports in 28 seconds via natural language queries. Results: 99.86% alert reduction, 28-second case generation (vs 25min manual), 14-day predictive lead time, $178K+ fraud exposure detected across 3 rings and 73 entities.

7 Feb 2026